Association promoted by the United Nations, focused on the development of sustainable securities markets.

Sustainability

Sustainability at Latinex

At Latinex, we recognize the important role we play in the transition towards sustainable development, as a central point of contact between issuers, investors and market intermediaries. We facilitate investment in climate, social and corporate governance solutions by making a base of potential investors available to issuers. Likewise, we support these investors in making responsible and impact investments.

Our purpose

Develop and promote the Panamanian stock market in a transparent and efficient manner, under the highest standards of corporate governance, which allow the construction of a sustainable capital market, which contributes to the social and economic development of the country.

Our strategic priorities

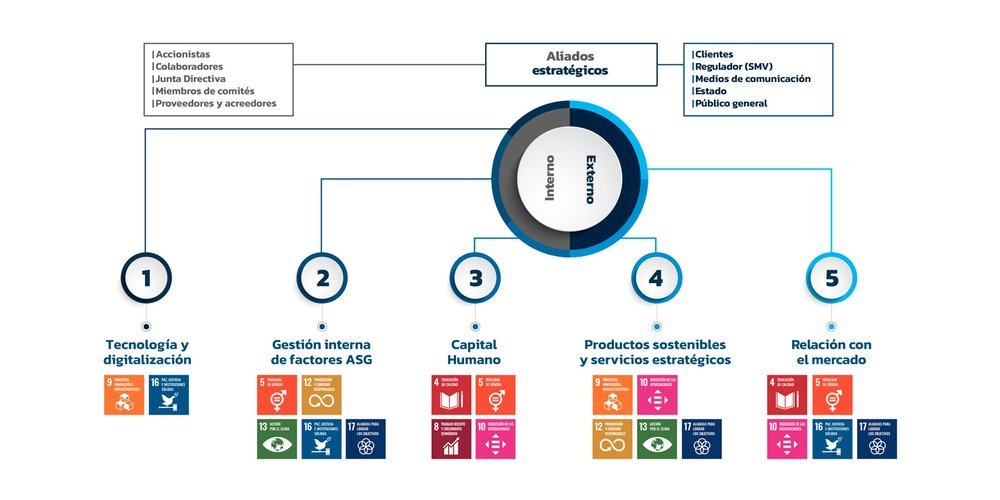

Based on the results of the materiality analysis, we have established five strategic priorities and their respective objectives, shaping the Sustainability Strategy of Latinex Holdings, Inc. and subsidiaries, which will allow us to guide our actions in terms of sustainability.

Our evolution

We contribute to the Sustainable Development Goals (SDGs), which are part of the 2030 Agenda proposed by the United Nations to address the major challenges of our society. To this end, we have focused on actively participating through various initiatives and commitments that allow us to contribute to this goal.

Adherence to the SSE:

Creation of the Sustainable Finance Working Group:

Working group made up of various actors from the local financial sector, all contributing to the sustainable development of our sector.

Strategic Alliances:

Addition to initiatives such as the Women's Empowerment Principles, Climate Bonds Initiative (CBI), Sumarse, TCFD, PRI and work together with multilateral organizations such as the IDB.

First Green Bond:

Issuance of the first green bond for Panama, issued by CIFI with a listing amount of USD 200 million.

Launch Guides:

Launch of guides for the issuance and disclosure of ESG factors in conjunction with the CBI and the IDB.

Reduce your Footprint Program:

Adherence to the first 50 carbon neutral organizations of MiAmbiente.

First sustainability report:

First sustainability report and strategy under GRI and SASB standards.

Internal Politics:

Implementation of initiatives for our employees such as paid paternity leave and a corporate volunteer program.

World Federation of Stock Exchanges:

Incorporation into the Sustainable Finance Working Group of the World Federation of Stock Exchanges.

Alliances

UNEP Finance Initiative |

UN Women |

Climate Bonds Initiative |

Net Zero Financial Service Providers Alliance |

The International Sustainability Standards Board (ISSB) |

Accessions

Sustainable Stock Exchanges Initiative |

United Nations Global Compact |

Ibero-American Federation of Stock Exchanges |

Capital Markets Association of the Americas |

World Federation of Exchanges |

Corporate Governance Institute |

Sumarse |

Sustainable Finance Working Group |

Gender Parity Initiative |

In Support of Women's Powerment Principles |

Voluntary Sustainability Index, Policies, Guidelines and Reports

To download the document in PDF format, please click on the corresponding image.

Sustainable emissions

| Issuer | Ticker | Instrument | Emission | Expiration | Rate | Series amount | Price |

|---|